LLCs also make it possible for for versatility in the way in which they are managed — members can manage the day by day operations of the LLC or they will employ the service of an outside manager.

The operator of a sole proprietorship experiences business cash flow and earnings on their own tax returns. Be prepared to pay back a self-work tax, which as of 2023 is fifteen.3%. Compared with LLCs, sole proprietors take on all risks and have no liability security.

This is why an running agreement is necessary: It can help making sure that courts will regard your personal liability security by displaying you are already conscientious about Arranging your LLC.

Closed organizations deficiency a traditional corporate construction. Instead of publicly traded shares, the company is run by A personal team of shareholders; no board of administrators is required.

Clarity with business associates In case you co-possess your business with partners, the whole process of establishing an LLC will prompt you to possess a great deal of useful discussions. Who’s liable for what?

Another important advantage of an LLC is definitely the go-as a result of taxation. An LLC just isn't topic to corporate taxes. Rather, all gains and losses are passed along into the house owners. Your business income are only taxed the moment.

Acquiring an EIN is important for anyone trying to get to start an LLC. 1st, it is an important indicates of separating your business entity and assets from a have funds.

A limited liability company (LLC) separates a company from its owners, protecting the entrepreneurs from any money losses, debts or legal liabilities which the business might incur.

The 1st and highest-precedence stage is opening a business banking account to serve as the home base of the LLC’s fiscal operations.

On the other hand, the LLC creates a separation between both you and your business. Put simply, If the business is subject into a lawsuit or other lawful issues, you may well be safeguarded.

Business cost savings: This account earns fascination on further money; Best LLC Service Even though the curiosity level is typically lower than personal price savings accounts but could give a lot more benefits for business homeowners.

You get to make your mind up how you're taxed—as an LLC or a corporation—To optimize your ability to economize and lower tax liability.

Once-a-year report: Business Name Search Virtually every state needs you to definitely file an once-a-year report every year to maintain your LLC in fantastic standing. The normal yearly report fee is $104, although in some states it’s as low as $0.

Each and every condition lists its precise Best LLC Service requirements and processes for anyone looking to form an LLC. Primary information you’ll want to supply includes:

Spencer Elden Then & Now!

Spencer Elden Then & Now! Jennifer Love Hewitt Then & Now!

Jennifer Love Hewitt Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Barbara Eden Then & Now!

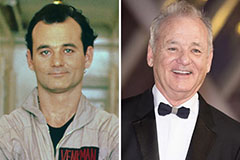

Barbara Eden Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!